iowa capital gains tax rates

Not all states impose a state tax on capital gains. The top rate will lower to 39 applying the same rate to all taxpayers.

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

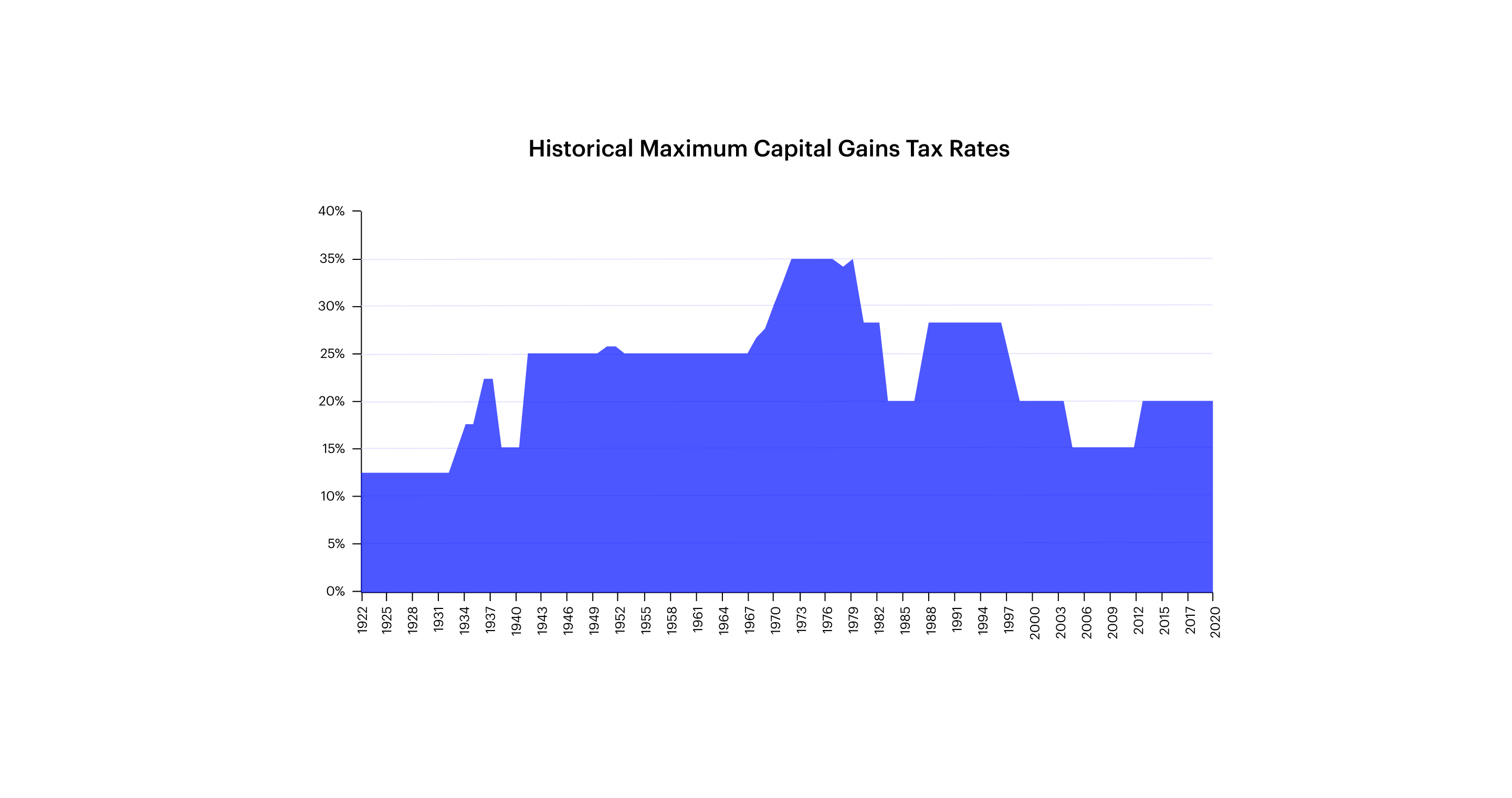

Rounded to the nearest whole percent this average is 30 percent.

. IA 100A - IA 100F Capital Gain Deduction Information and Links to Forms Instructions 41-161. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay will generally be lower as the state allows a deduction for federal income tax. This process will continue.

Iowa has a relatively high capital gains tax rate of 853 but the amount an. Additional State Capital Gains Tax Information for Iowa Iowa allows taxpayers to deduct federal income taxes from their state taxable income. Introduction to Capital Gain Flowcharts.

This marginal tax rate means. Just like income tax youll pay a tiered tax rate on your capital gains. The top rate will lower to 6 giving a tax cut to Iowans making 75000 or more.

The states with the highest capital gains tax are as follows. When a landowner dies the basis is automatically reset to the current fair. The Iowa capital gain deduction is subject to review by the Iowa Department of.

Adding two percentage points results in the annual Department rate of 50 percent. 3 rows Does Iowa have a capital gains tax. The various types of sales resulting in capital gain have specific guidelines which must be met to qualify for the Iowa capital gain deduction.

Costs of Sale transactional expenses commissions. Your average tax rate is 1198 and your marginal tax rate is 22. California taxes capital gains as ordinary income.

- Law info 1 week ago Jun 30 2022 Iowa is a somewhat different story. If that amount exceeds 700 million the law will require a rate reduction based upon the rate that would have generated 700 million in that year. State Tax Rate ex.

The monthly rate is the. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains. If line 6 of the IA 1040 includes a capital gain transaction you may have a qualifying Iowa capital gain deduction.

Inheritance Tax Rates Schedule. The Combined Rate accounts for Federal State. If you make 70000 a year living in the region of Iowa USA you will be taxed 14177.

Iowa is a somewhat different story. For sales made on or after January 1 1990 Iowa taxpayers could claim a 45 deduction. For example a single person with a total short-term capital gain of 15000 would pay 10 of 10275.

CPEC1031 of Iowa provides qualified. How Much Is Capital Gains Tax In Iowa. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years.

The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax Form. The highest rate reaches 133. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay will generally be lower as the state.

The Overwhelming Case Against Capital Gains Taxation International Liberty

Capital Gains Tax In The United States Wikipedia

Small Business Entrepreneurship Council

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Texas Capital Gains Tax A Short Guide Four 19 Properties

2022 Capital Gains Tax Rates By State Smartasset

States With The Highest Capital Gains Tax Rates

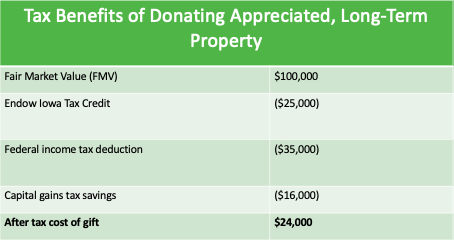

Final Four 4 Amazing Tax Breaks For Iowans On Charitable Gifts

Capital Gains Tax Calculator Estimate What You Ll Owe

How To Avoid Capital Gains Taxes In Georgia Breyer Home Buyers

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

How High Are Capital Gains Taxes In Your State Tax Foundation

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

How Do State And Local Individual Income Taxes Work Tax Policy Center

1031 Exchange Iowa Capital Gains Tax Rate 2022

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

States With The Highest Capital Gains Tax Rates

The High Burden Of State And Federal Capital Gains Tax Rates In The United States Tax Foundation